Switzerland Video

Navigating Local Taxes and Business Regulations in Switzerland

Switzerland, known for its breathtaking landscapes and robust economy, offers a favorable business environment. However, understanding and navigating the local taxes and business regulations is crucial for entrepreneurs and businesses operating in the country. This article provides a comprehensive guide to help you navigate through the intricacies of local taxes and business regulations in Switzerland.

Local Taxes in Switzerland

Local taxes in Switzerland play a significant role in the overall tax system. The Swiss tax system is decentralized, with taxes levied at different levels: federal, cantonal (state), and municipal. Here are some key points to consider:

- Income Tax: Income tax is levied at both the federal and cantonal levels. The rates and tax brackets vary between cantons. It is essential to understand the specific income tax regulations in the canton where your business operates.

- Corporate Tax: Corporate tax is also imposed at both the federal and cantonal levels. The tax rates and regulations differ between cantons, making it crucial to carefully evaluate the tax implications before establishing a business presence in Switzerland.

- Value Added Tax (VAT): Switzerland has a VAT system, which is levied on the supply of goods and services. The standard VAT rate is 7.7%, but there are reduced rates for certain goods and services. Businesses with an annual turnover exceeding a certain threshold must register for VAT.

- Real Estate Taxes: Real estate taxes are imposed at the municipal level and vary depending on the location and value of the property. It is important to consider these taxes when acquiring or owning real estate in Switzerland.

Business Regulations in Switzerland

Switzerland has a business-friendly regulatory framework that promotes entrepreneurship and economic growth. However, there are still specific regulations and requirements that businesses need to comply with. Here are some key aspects to be aware of:

- Business Formation: To establish a business in Switzerland, you need to choose a legal structure, such as a sole proprietorship, partnership, or corporation. Each legal form has different requirements and implications, so it is advisable to seek legal advice when deciding on the most suitable structure for your business.

- Work Permits: Non-Swiss residents who wish to work in Switzerland need to obtain a work permit. The type of permit required depends on various factors, including the duration and nature of employment. It is essential to familiarize yourself with the work permit regulations and ensure compliance.

- Employment Laws: Switzerland has strict employment laws that govern various aspects, including working hours, minimum wages, vacation entitlements, and termination procedures. It is crucial to understand and comply with these laws to avoid legal issues.

- Intellectual Property Protection: Switzerland provides robust intellectual property protection. It is advisable to register trademarks, patents, or copyrights to safeguard your intellectual property rights and prevent infringement.

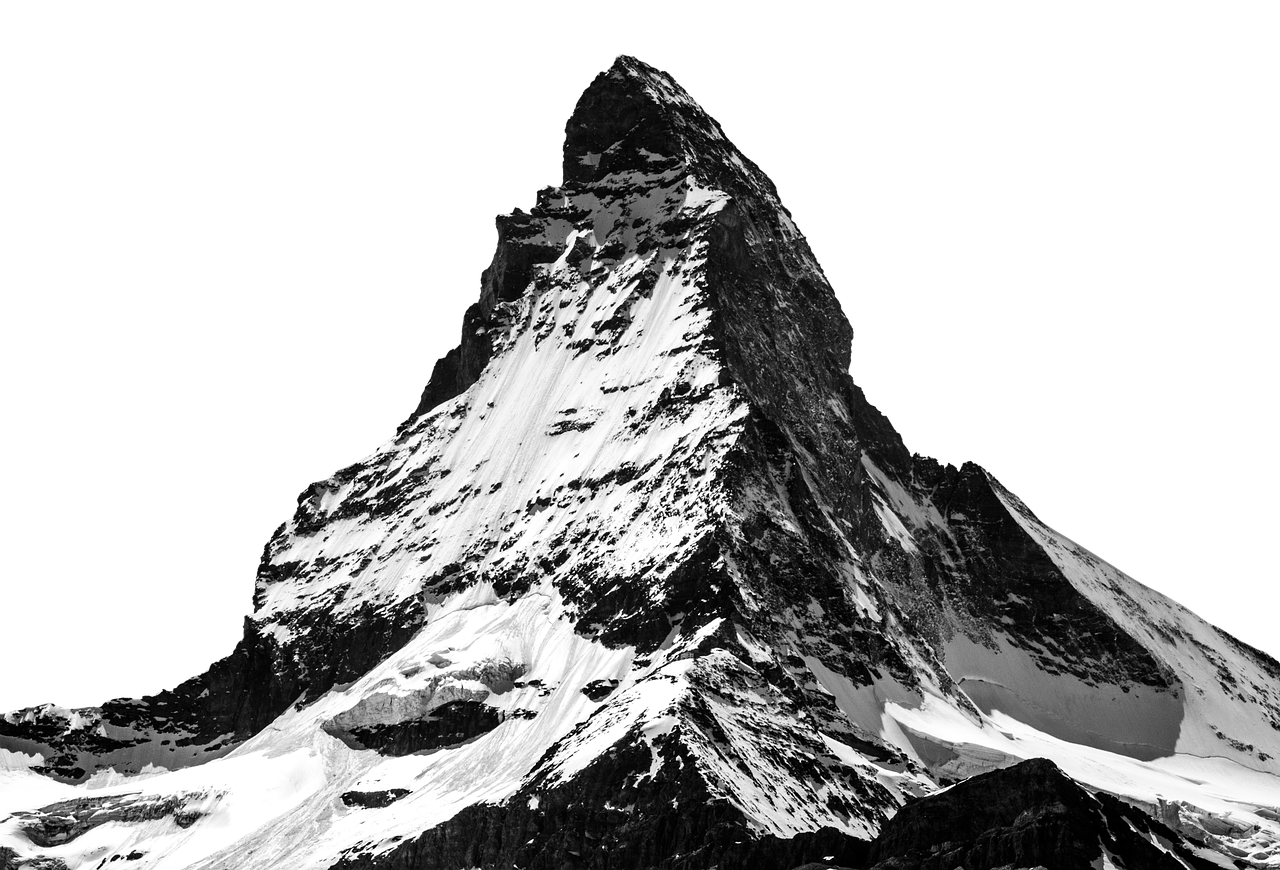

Switzerland Image 1:

Local Tax Incentives

Switzerland offers various tax incentives to attract businesses and encourage economic development. These incentives vary between cantons and may include:

- Tax Holidays: Some cantons provide tax holidays for newly established businesses, reducing or exempting them from certain taxes for a specified period. This can provide significant cost savings during the initial stages of a business.

- Research and Development (R&D) Deductions: Many cantons offer R&D deductions, allowing businesses to reduce their taxable income by a percentage of their R&D expenses. This incentivizes innovation and technological advancements.

- Special Economic Zones: Certain regions in Switzerland are designated as special economic zones, offering favorable tax conditions and other incentives to attract businesses. These zones often have lower tax rates and simplified administrative procedures.

Switzerland Image 2:

Compliance and Reporting Obligations

Switzerland has strict compliance and reporting obligations that businesses must fulfill. These include:

- Annual Financial Statements: Businesses are required to prepare annual financial statements in accordance with Swiss accounting standards. These statements must be audited by a licensed auditor for certain types of entities.

- Tax Returns: Businesses must file annual tax returns at the federal, cantonal, and municipal levels. The tax returns should accurately report the business’s income, expenses, and other relevant financial information.

- Social Security Contributions: Employers are obligated to contribute to the Swiss social security system on behalf of their employees. This includes contributions for pension, disability, and unemployment insurance.

- Annual General Meetings: Publicly traded companies and certain other entities are required to hold annual general meetings, where shareholders can exercise their rights and receive updates on the company’s performance.

Switzerland Image 3:

Conclusion

Navigating local taxes and business regulations in Switzerland is essential for the success and compliance of your business. Understanding the intricacies of the tax system, complying with reporting obligations, and adhering to business regulations will help you establish a strong foundation for your business in Switzerland. Seeking professional advice and staying updated on regulatory changes are key to ensuring smooth operations and maximizing your business’s potential in this beautiful country.

References

– Federal Tax Administration: www.estv.admin.ch

– State Secretariat for Economic Affairs: www.seco.admin.ch

– Swiss Official Gazette of Commerce: www.shab.ch

– Swiss Federal Institute of Intellectual Property: www.ige.ch

– Swiss Federal Customs Administration: www.ezv.admin.ch