Japan Video

Managing Finances and Payments while Working in Japan

Japan is a vibrant country known for its rich culture, technological advancements, and bustling cities. If you are planning to work in Japan, it is essential to understand how to manage your finances and payments effectively. This article will guide you through various aspects of managing your money in Japan, including opening a bank account, understanding the currency, tax obligations, and more.

Opening a Bank Account

One of the first steps you should take upon arriving in Japan is to open a bank account. Having a local bank account will make it easier to receive your salary, pay bills, and manage your finances efficiently. To open a bank account, you will need to visit a branch in person and provide the necessary documents, which typically include:

- Residence Card: Your valid residence card as proof of your residency in Japan.

- Proof of Address: A document that verifies your current address in Japan, such as a utility bill or rental contract.

- Personal Seal: In Japan, it is common to use a personal seal (hanko) instead of a signature. You may need to bring your personal seal when opening a bank account.

It is advisable to research different banks and compare their services and fees before making a decision. Some popular banks in Japan include Mizuho Bank, Sumitomo Mitsui Banking Corporation (SMBC), and MUFG Bank.

Understanding the Currency

The official currency of Japan is the Japanese Yen (JPY). It is important to familiarize yourself with the currency and its denominations to handle transactions smoothly. The yen is available in coins (1, 5, 10, 50, 100, and 500 yen) and banknotes (1,000, 2,000, 5,000, and 10,000 yen).

When making purchases, it is common to use cash in Japan, especially for smaller transactions. However, credit and debit cards are widely accepted in larger establishments, such as department stores and hotels. It is advisable to carry some cash with you at all times, as some smaller businesses may only accept cash payments.

Tax Obligations

As a worker in Japan, you will be subject to various tax obligations. The two primary taxes to be aware of are income tax and consumption tax.

- Income Tax: Your employer will deduct income tax directly from your salary. The amount of income tax you pay depends on your income level and tax bracket. Japan operates on a progressive tax system, where higher income earners are taxed at a higher rate.

- Consumption Tax: Consumption tax is a value-added tax imposed on goods and services in Japan. The current consumption tax rate is 10%. It is added to the final price of most goods and services.

It is important to keep track of your income and expenses throughout the year to ensure accurate tax calculations. Consulting with a tax professional or using tax software can be helpful in managing your tax obligations in Japan.

Managing Expenses

Living and working in Japan comes with various expenses. To effectively manage your expenses, it is crucial to create a budget and track your spending. Here are some tips to help you manage your expenses:

- Create a Budget: Assess your monthly income and allocate funds to different categories such as rent, utilities, transportation, groceries, and leisure activities. Stick to your budget to ensure you are living within your means.

- Save on Housing: Consider different housing options, such as shared apartments or guesthouses, to reduce your rental expenses. Research the average rental prices in the area you plan to live in to make an informed decision.

- Transportation: Utilize public transportation options like trains and buses, as they are often more cost-effective than owning a car. Consider purchasing a commuter pass if you frequently travel to work via public transport.

- Cook at Home: Eating out in Japan can be expensive, especially in major cities. Save money by cooking meals at home and packing your lunch for work.

- Entertainment and Leisure: Take advantage of free or low-cost activities in Japan, such as visiting public parks, exploring local festivals, or joining community events. This way, you can enjoy your time without overspending.

Managing International Money Transfers

If you need to send money internationally or receive funds from overseas while working in Japan, there are several options available:

- Bank Transfers: Most banks in Japan offer international money transfer services. However, these transfers can be costly due to fees and unfavorable exchange rates. It is advisable to compare fees and exchange rates across different banks before making a transfer.

- Online Money Transfer Services: Online money transfer services, such as TransferWise or PayPal, offer competitive rates and lower fees compared to traditional banks. These services are convenient and can be accessed through mobile apps or websites.

- Foreign Exchange Companies: Foreign exchange companies specialize in international money transfers and often provide better exchange rates and lower fees compared to banks. Research reputable foreign exchange companies and compare their rates before making a transaction.

Insurance and Healthcare

Healthcare in Japan is of high quality but can be expensive. It is mandatory for all residents to enroll in the National Health Insurance (NHI) system. The NHI system covers a portion of medical expenses, with the remaining amount paid out of pocket.

It is also recommended to have additional health insurance, such as private health insurance or employer-provided insurance, to further reduce medical costs. Research different insurance options and choose a plan that suits your needs and budget.

Retirement Savings

Planning for retirement is important, even while working in Japan. The country offers various retirement savings options, such as the Employees’ Pension Insurance and the National Pension System.

Under the Employees’ Pension Insurance, both you and your employer make contributions towards your retirement fund. The National Pension System is for self-employed individuals and those who do not qualify for the Employees’ Pension Insurance. It is advisable to consult with a financial advisor to understand the best retirement savings strategy for your specific situation.

Japan Image 1:

Tips for Saving Money

Living in Japan can be expensive, but with some smart financial decisions, you can save money during your stay:

- Shop at Discount Stores: Look for discount stores like Daiso or Don Quijote for affordable household items and groceries.

- Use Discount Coupons: Take advantage of discount coupons and special offers available at supermarkets, restaurants, and entertainment venues.

- Consider Second-Hand Items: Buying second-hand items can save you money on furniture, electronics, and clothing. Check out websites like Mercari or visit local thrift stores.

- Utilize Free Wi-Fi: Instead of purchasing a mobile data plan, take advantage of the numerous free Wi-Fi spots available in Japan. Many cafes, libraries, and train stations offer free Wi-Fi access.

- Travel Smart: Plan your travels in advance to take advantage of discounted transportation options, such as off-peak train tickets or budget airlines.

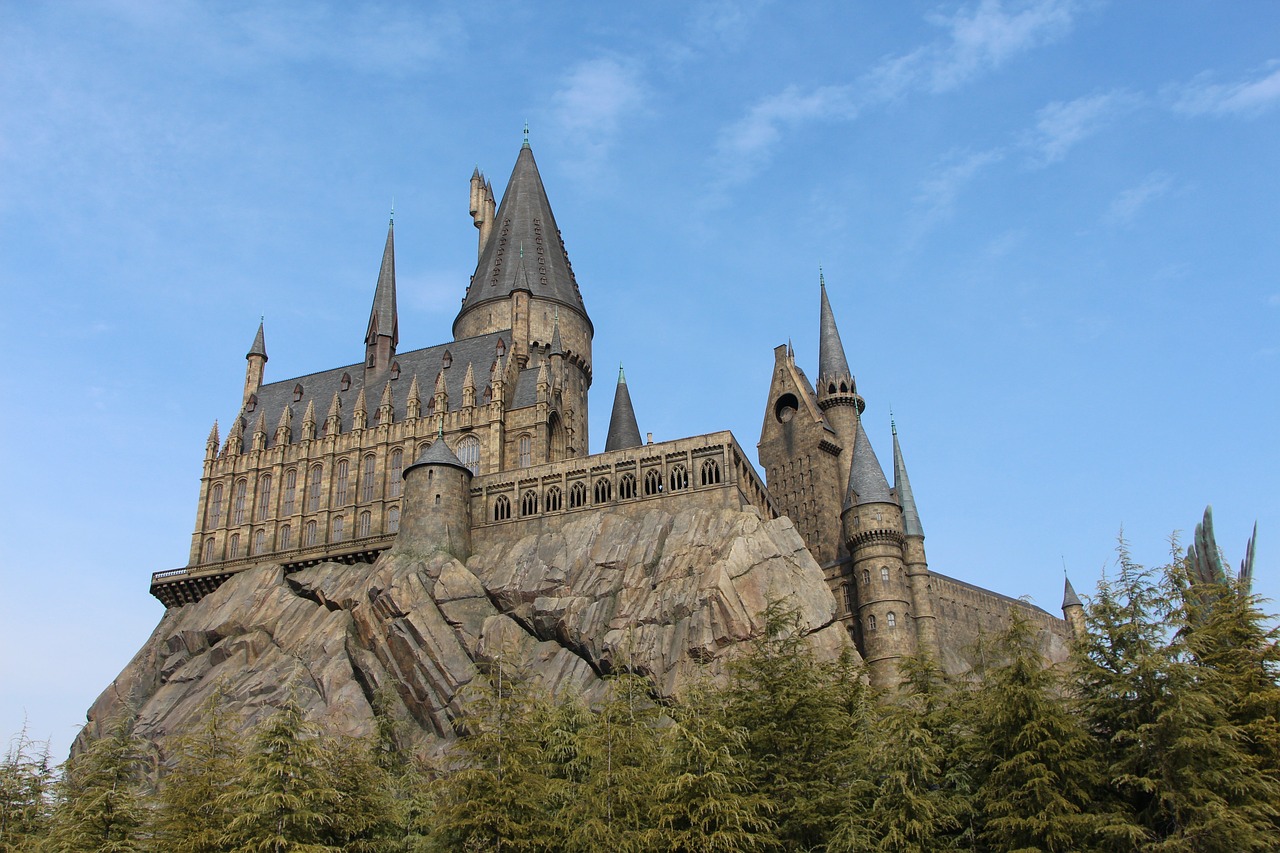

Japan Image 2:

Conclusion

Managing finances and payments while working in Japan requires careful planning and understanding of the country’s financial systems. By opening a bank account, understanding the currency, fulfilling tax obligations, and effectively managing expenses, you can navigate the financial landscape of Japan with confidence. Additionally, being aware of international money transfer options, insurance and healthcare, and retirement savings will contribute to a secure and comfortable stay in Japan.

Japan Image 3:

References

- Mizuho Bank – https://www.mizuhobank.co.jp/

- Sumitomo Mitsui Banking Corporation – https://www.smbc.co.jp/

- MUFG Bank – https://www.bk.mufg.jp/

- TransferWise – https://transferwise.com/

- PayPal – https://www.paypal.com/

- National Health Insurance – https://www.nhi.or.jp/

- Daiso – https://www.daiso-sangyo.co.jp/

- Don Quijote – https://www.donki.com/

- Mercari – https://www.mercari.com/