Bahamas Video

Navigating Local Taxes and Business Regulations in Bahamas

The Bahamas is a popular destination for tourists and businesses alike. Whether you are starting a new business or expanding your operations to the Bahamas, it is important to understand the local tax laws and business regulations. This article will provide a comprehensive guide to help you navigate the intricacies of local taxes and business regulations in the Bahamas.

Overview of Bahamas Tax System

The Bahamas has a tax system based on territoriality, which means that only income derived from within the country is subject to taxation. The main taxes imposed in the Bahamas include:

- Business License Tax: All businesses operating in the Bahamas are required to obtain a business license and pay an annual fee based on the nature and size of the business.

- Value Added Tax (VAT): The Bahamas implemented a VAT system in 2015, which is levied on the sale of goods and services at a standard rate of 12%. Some goods and services may be exempt or subject to a reduced rate.

- Real Property Tax: Property owners in the Bahamas are required to pay an annual tax on the assessed value of their property. The rate varies depending on the type and use of the property.

- Customs Duties: Importers are subject to customs duties on goods imported into the Bahamas. The rates vary depending on the type of goods and their country of origin.

- Stamp Duty: Stamp duty is applicable on various transactions, including property transfers, leases, and certain legal documents. The rates vary depending on the nature of the transaction.

Registering a Business in the Bahamas

Before you can start operating a business in the Bahamas, you must register your business with the relevant authorities. The process involves the following steps:

- Choose a Business Name: Select a unique name for your business that complies with the naming conventions set by the Registrar General’s Department.

- Business License Application: Complete the business license application form and submit it along with the required supporting documents to the Bahamas Investment Authority (BIA).

- Tax Registration: Register for tax purposes with the Department of Inland Revenue. This includes obtaining a Tax Identification Number (TIN) and registering for VAT, if applicable.

- Work Permit: If you are a non-Bahamian and plan to work in your business, you will need to apply for a work permit from the Department of Immigration.

Complying with Employment Regulations

If you plan to hire employees in the Bahamas, it is important to understand and comply with the local employment regulations. Some key points to consider include:

- Work Permits: Non-Bahamian employees generally require a work permit, which must be obtained before they can legally work in the country.

- Minimum Wage: The Bahamas has a minimum wage, which is revised periodically. Ensure that you pay your employees at least the minimum wage set by law.

- Employment Contracts: It is advisable to have written employment contracts in place to clearly outline the terms and conditions of employment.

- Employee Benefits: Familiarize yourself with the mandatory employee benefits such as vacation leave, sick leave, and public holidays.

Business Reporting and Compliance

To maintain compliance with local regulations, businesses in the Bahamas must adhere to certain reporting and compliance requirements. Some key obligations include:

- Financial Statements: Prepare and submit annual financial statements to the Registrar General’s Department.

- Tax Returns: File tax returns with the Department of Inland Revenue, reporting your business income and paying any applicable taxes.

- Record Keeping: Maintain accurate records of your business transactions, including invoices, receipts, and financial statements.

- Annual Returns: Submit annual returns to the Registrar General’s Department, providing updated information about your business.

Business Incentives and Exemptions

The Bahamas offers various incentives and exemptions to attract foreign investment and promote economic growth. Some notable incentives include:

- Investment Incentives Act: This legislation provides tax incentives and other benefits to businesses engaged in specified industries or activities.

- Special Economic Zones: The Bahamas has designated certain areas as Special Economic Zones, offering tax benefits and streamlined processes for businesses operating within these zones.

- Financial Services Incentives: The financial services sector in the Bahamas enjoys specific incentives and exemptions to promote the growth of this industry.

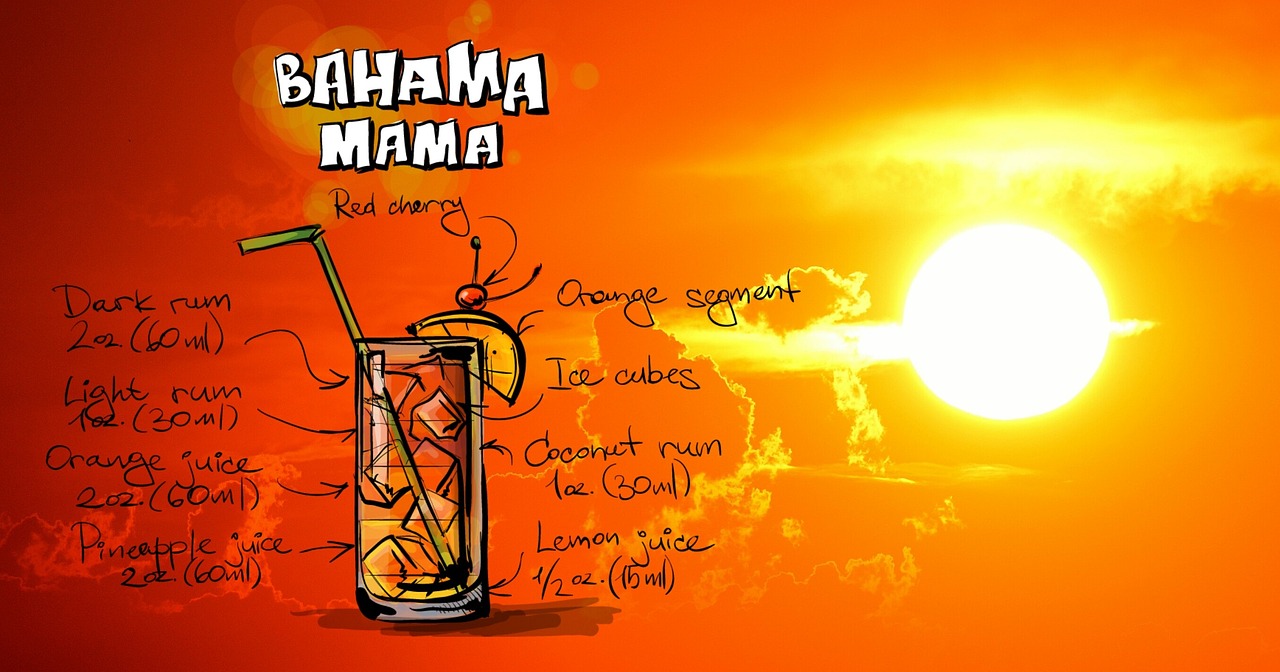

Bahamas Image 1:

Conclusion

Navigating local taxes and business regulations in the Bahamas can be complex, but with the right knowledge and guidance, you can ensure compliance and maximize your business’s success. It is essential to consult with local experts or professional advisors to ensure that you meet all legal requirements and take advantage of available incentives. By understanding the tax system, registering your business, complying with employment regulations, and fulfilling reporting obligations, you can establish and grow your business in the Bahamas successfully.

References

– Department of Inland Revenue: www.inlandrevenue.finance.gov.bs

– Registrar General’s Department: www.registrargeneral.gov.bs

– Bahamas Investment Authority: www.bahamasinvestmentauthority.bs