Navigating Local Taxes and Business Regulations in Finland

Finland is known for its strong economy and business-friendly environment. However, like any other country, it has its own set of local taxes and business regulations that need to be understood and adhered to by entrepreneurs and businesses operating within its borders. This article aims to provide a comprehensive guide on navigating local taxes and business regulations in Finland, covering various aspects such as corporate taxes, value-added tax (VAT), social security contributions, and more.

Corporate Taxes

Finland has a corporate tax system that applies to both domestic and foreign companies operating in the country. The corporate tax rate in Finland is currently set at 20%. It is important for businesses to be aware of their tax obligations and ensure timely compliance with the Finnish Tax Administration (Verohallinto). Here are some key points to consider:

- Taxable Income Calculation: Corporate taxes are levied on the taxable income of a company, which is calculated by deducting allowable expenses from the company’s revenue.

- Loss Carryforward: Finland allows companies to carry forward tax losses for up to ten years. These losses can be offset against future profits, reducing the tax liability.

- Dividends: Companies distributing dividends are subject to a separate tax known as the dividend tax. The current dividend tax rate in Finland is 25%.

Allowable expenses may include employee salaries, rental expenses, marketing costs, and other legitimate business expenses.

This provision is beneficial for businesses that may experience temporary losses in certain years.

It is important to consider the impact of dividend taxes when planning to distribute profits to shareholders.

Value-Added Tax (VAT)

Value-Added Tax (VAT) is an important consideration for businesses operating in Finland. VAT is levied on the sale of goods and services and is collected by businesses on behalf of the Finnish Tax Administration. Here are some key points regarding VAT in Finland:

- VAT Rates: Finland has multiple VAT rates depending on the type of goods or services sold. The standard VAT rate is currently 24%, while reduced rates of 14% and 10% apply to certain goods and services.

- Registration Threshold: Businesses with an annual turnover exceeding €10,000 must register for VAT in Finland.

- VAT Reporting: Registered businesses are required to submit regular VAT reports to the Finnish Tax Administration, detailing their VAT transactions.

Examples of goods and services subject to reduced rates include food, books, and passenger transportation.

It is important for businesses to monitor their turnover to determine if they need to register for VAT.

These reports help the tax authorities track VAT payments and refunds.

Social Security Contributions

In Finland, social security contributions play a crucial role in funding the country’s welfare system. Employers and employees are both responsible for contributing to social security. Here are some important points to note:

- Employer Contributions: Employers are required to contribute to various social security programs, including pension insurance, unemployment insurance, and healthcare insurance.

- Employee Contributions: Employees also make contributions to social security programs through deductions from their salaries.

- Reporting and Payment: Employers are responsible for reporting and paying the social security contributions to the relevant authorities.

The contribution rates vary depending on factors such as the employee’s salary and the type of insurance.

The employee contribution rates are determined based on the employee’s salary and the specific social security programs.

It is important for businesses to accurately calculate and fulfill their social security obligations.

Employment Regulations

When doing business in Finland, it is essential to comply with the country’s employment regulations. These regulations cover various aspects, including employment contracts, working hours, and employee rights. Here are some key points to consider:

- Employment Contracts: Finnish law requires employers to provide written employment contracts to their employees.

- Working Hours: The standard working week in Finland is 40 hours. Overtime work is subject to specific regulations, including compensation and rest periods.

- Employee Rights: Finnish law grants employees various rights, including vacation entitlement, sick leave, and parental leave.

The contracts should outline the terms and conditions of employment, including working hours, compensation, and benefits.

Employers must ensure compliance with working hour regulations to avoid legal issues.

Employers must be aware of these rights and provide the necessary support and benefits to their employees.

Intellectual Property Rights

Protecting intellectual property (IP) is crucial for businesses operating in Finland. The country has a robust legal framework for IP protection, including patents, trademarks, and copyrights. Here are some important considerations:

- Patents: Patents grant exclusive rights to inventors, protecting their inventions from unauthorized use or reproduction.

- Trademarks: Trademarks protect brands and logos, preventing others from using similar marks that may cause confusion among consumers.

- Copyrights: Copyrights protect original works of authorship, such as literary, artistic, and musical creations.

Businesses with innovative products or processes should consider obtaining patents to safeguard their IP.

Registering trademarks can help businesses establish a unique identity in the market.

Businesses should understand their rights and obligations regarding copyrighted materials.

Environmental Regulations

Finland places a strong emphasis on environmental protection and sustainability. Businesses operating in the country must comply with environmental regulations to minimize their impact on the environment. Here are some key points:

- Waste Management: Proper waste management practices are essential for businesses in Finland.

- Energy Efficiency: Finland encourages businesses to adopt energy-efficient practices to reduce their carbon footprint.

- Environmental Permits: Certain industries may require environmental permits to operate legally.

Companies must adhere to regulations regarding waste disposal, recycling, and hazardous materials.

Implementing energy-saving measures can lead to cost savings and improved environmental performance.

Businesses should consult with the relevant authorities to ensure compliance with permit requirements.

Conclusion

Navigating local taxes and business regulations in Finland is crucial for entrepreneurs and businesses looking to establish and operate successfully in the country. By understanding the corporate tax system, VAT regulations, social security contributions, employment regulations, intellectual property rights, and environmental regulations, businesses can ensure compliance and make informed decisions. It is important to seek professional advice and stay updated on any changes in the Finnish legal and regulatory landscape.

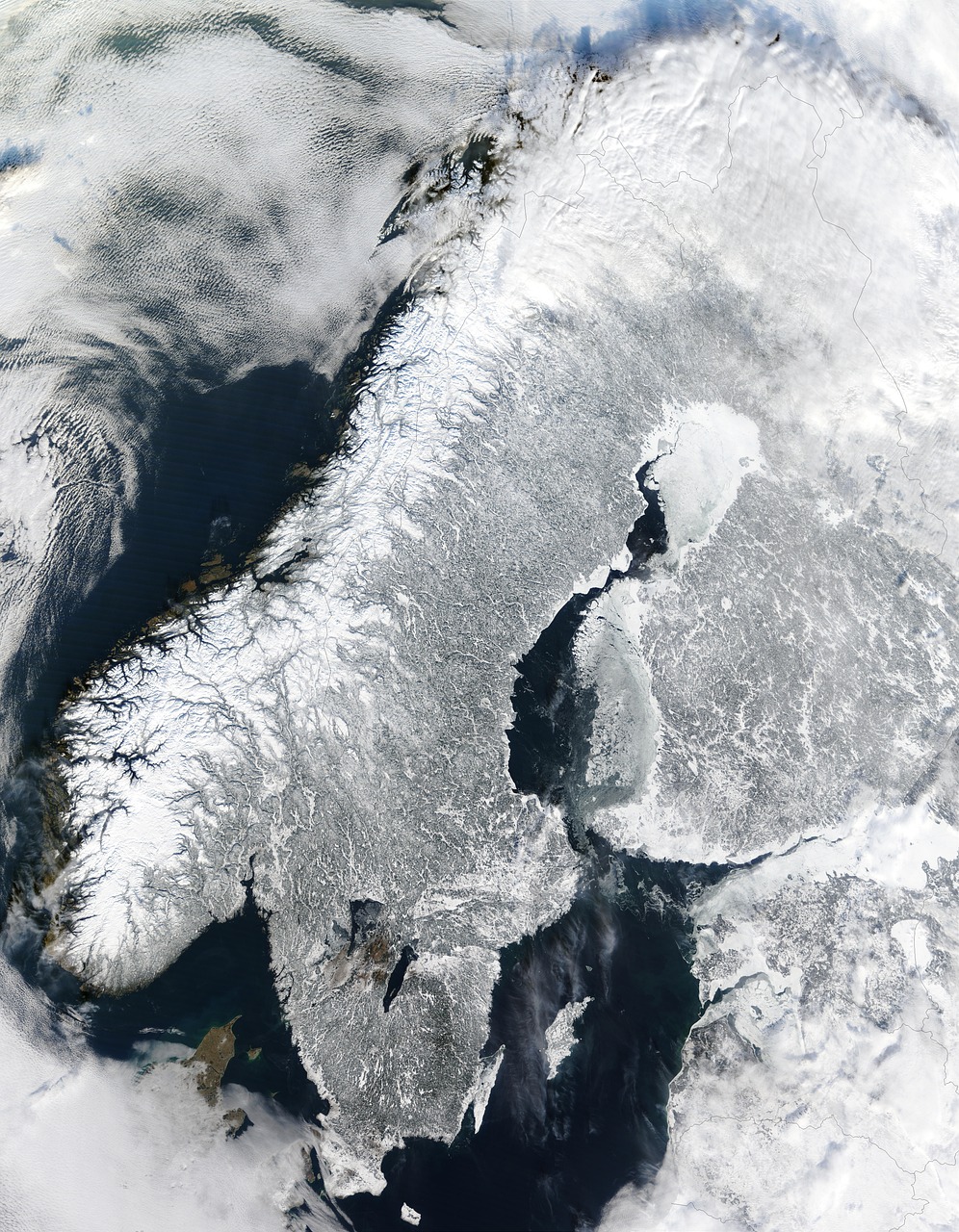

Finland Image 1:

Finland Image 2:

Finland Image 3:

References

- vero.fi

- finlex.fi

- patentti-ja-rekisterihallitus.fi

- tem.fi