Navigating Local Taxes and Business Regulations in India

India is a vast and diverse country with a rapidly growing economy. As a result, navigating local taxes and business regulations in India can be a complex task. This article aims to provide a comprehensive guide to help businesses understand and comply with the various tax laws and regulations in India.

Section 1: Introduction to Indian Tax System

India has a federal system of government, which means that both the central government and state governments have the power to impose taxes. The central government is responsible for levying direct taxes, such as income tax, while the state governments have the authority to impose indirect taxes, such as sales tax and value-added tax (VAT). Understanding the structure and hierarchy of the Indian tax system is crucial for businesses operating in India.

- Income Tax: Income tax is levied on the income earned by individuals, companies, and other entities. The tax rates vary based on the income brackets and types of entities.

- Sales Tax and VAT: Sales tax and VAT are imposed on the sale of goods within a state. The rates may vary from state to state, and businesses need to register for these taxes and comply with the respective state regulations.

- Goods and Services Tax (GST): GST is a unified tax system that replaced multiple indirect taxes like sales tax and VAT. It is applicable to the supply of goods and services across India and has different tax rates based on the nature of goods or services.

- Customs Duty: Customs duty is imposed on goods imported into or exported out of India. The rates may vary depending on the nature of goods and international trade agreements.

Section 2: Registering a Business in India

Before starting a business in India, it is essential to register the company with the appropriate authorities. The registration process may vary depending on the type of business entity, such as a sole proprietorship, partnership, or private limited company. Here are some key points to consider:

- Company Registration: Private limited companies are the most common form of business entities in India. The registration process involves obtaining a Digital Signature Certificate (DSC), Director Identification Number (DIN), and filing the necessary documents with the Registrar of Companies (ROC).

- GST Registration: Businesses with a turnover exceeding the prescribed threshold need to register for GST. The registration process involves obtaining a GST Identification Number (GSTIN) and filing the necessary forms with the Goods and Services Tax Network (GSTN).

- Professional Tax Registration: Some states in India impose a professional tax on individuals engaged in certain professions. Businesses need to register for professional tax and comply with the respective state regulations.

- Other Registrations: Depending on the nature of the business, additional registrations like Import-Export Code (IEC), Shops and Establishments Act, and Employee Provident Fund Organization (EPFO) may be required.

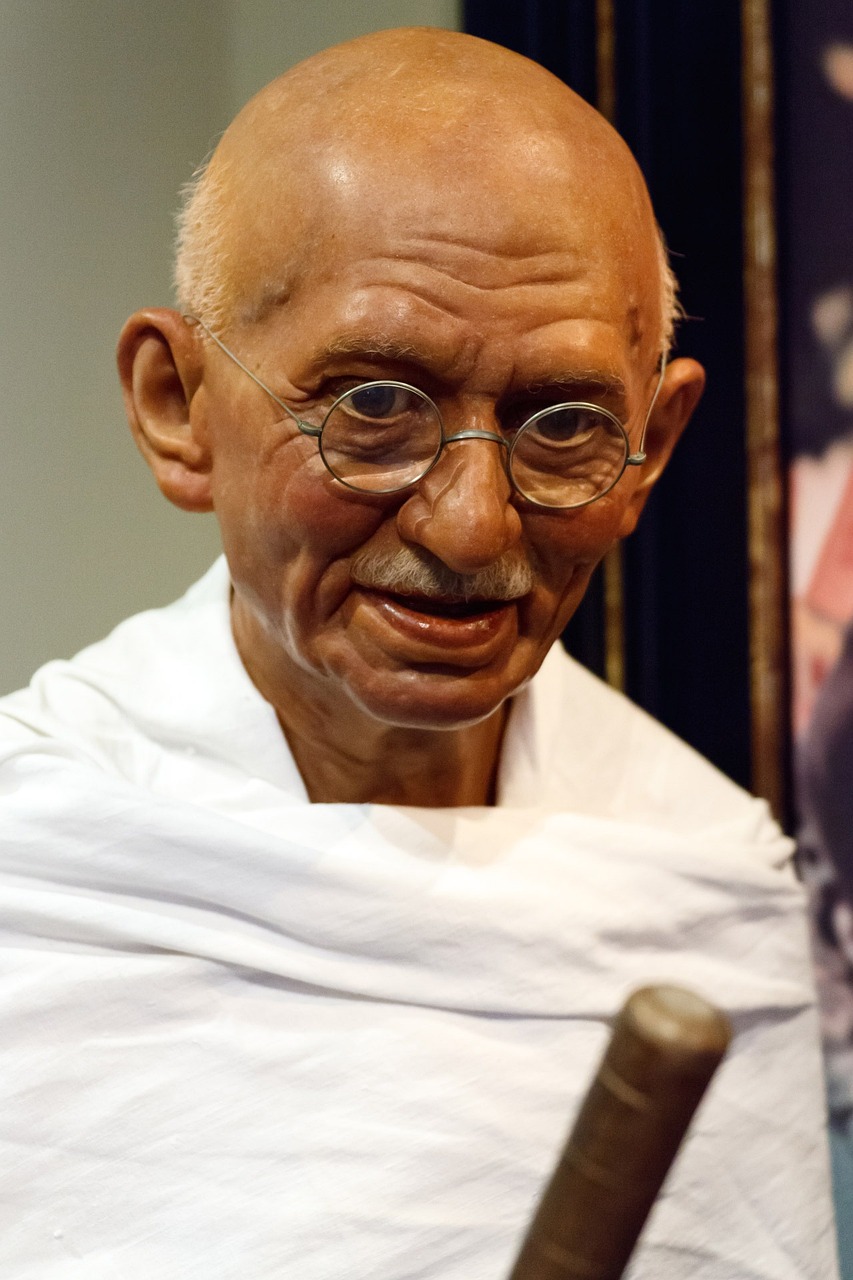

India Image 1:

Section 3: Understanding Direct Taxes in India

Direct taxes in India are levied on the income earned by individuals and entities. The Income Tax Act, 1961, governs the provisions related to income tax. Here are some key points to understand about direct taxes in India:

- Residential Status: The residential status of an individual or entity determines the tax liability in India. Residents are taxed on their worldwide income, while non-residents are taxed only on income earned in India.

- Income Tax Slabs: The income tax rates in India are categorized into different slabs based on the income levels. The rates may vary for individuals, Hindu Undivided Families (HUFs), and companies.

- Income Tax Returns: Every taxpayer is required to file an annual income tax return with the Income Tax Department. The due dates and filing procedures may vary depending on the type of taxpayer.

- Tax Deductions and Exemptions: The Income Tax Act provides various deductions and exemptions to reduce the tax liability. These include deductions for investments in specified schemes, allowances, and exemptions for certain types of income.

Section 4: Indirect Taxes in India

Indirect taxes in India are levied on the sale and consumption of goods and services. The Goods and Services Tax (GST) is the most significant indirect tax reform in India. Here are some key points to understand about indirect taxes in India:

- GST Registration: Businesses with a turnover exceeding the prescribed threshold need to register for GST. The registration process involves obtaining a GST Identification Number (GSTIN) and filing the necessary forms with the Goods and Services Tax Network (GSTN).

- GST Rates: GST has different tax rates based on the nature of goods or services. The rates are categorized into four slabs – 5%, 12%, 18%, and 28%. Some goods and services may attract nil or exempted rates.

- Input Tax Credit: Under the GST regime, businesses can claim input tax credit for the taxes paid on purchases. This helps in reducing the overall tax liability.

- E-Way Bill: For the movement of goods above certain thresholds, businesses need to generate an electronic waybill (E-Way Bill) to ensure proper documentation and compliance with GST regulations.

India Image 2:

Section 5: Customs Duties and Import-Export Regulations

India has specific customs duties and regulations for the import and export of goods. Understanding these regulations is crucial for businesses engaged in international trade. Here are some key points to consider:

- Customs Duty: Customs duty is imposed on goods imported into or exported out of India. The rates may vary depending on the nature of goods and international trade agreements.

- Customs Valuation: The value of imported goods for customs purposes is determined based on the transaction value or other prescribed methods. Businesses need to comply with the customs valuation rules to avoid any disputes.

- Import-Export Code (IEC): Businesses engaged in import or export activities need to obtain an Import-Export Code (IEC) from the Directorate General of Foreign Trade (DGFT).

- Documentation and Compliance: Importers and exporters are required to maintain proper documentation, including invoices, shipping bills, and export declarations. Compliance with customs regulations is essential to avoid penalties and delays.

Section 6: Business Licensing and Permits

Operating a business in India often requires obtaining various licenses and permits depending on the nature of the business activity. Here are some common licenses and permits required:

- Shops and Establishments Act: Businesses need to register under the respective state’s Shops and Establishments Act. This registration ensures compliance with labor laws and provides legal recognition to the business.

- Environmental Clearances: Certain industries or activities may require environmental clearances from the appropriate authorities to ensure compliance with environmental regulations.

- Food License (FSSAI): Businesses involved in food-related activities, such as restaurants or food processing units, need to obtain a Food License from the Food Safety and Standards Authority of India (FSSAI).

- Trade Licenses: Local municipal bodies issue trade licenses for businesses operating in specific areas. These licenses ensure compliance with local regulations and safety standards.

India Image 3:

Section 7: Tax Incentives and Special Economic Zones

The Indian government provides various tax incentives and benefits to promote specific industries, regions, or economic activities. Here are some key points to understand about tax incentives in India:

- Special Economic Zones (SEZs): SEZs are designated areas with special economic policies aimed at attracting foreign investments and promoting exports. Businesses operating in SEZs enjoy various tax benefits and exemptions.

- Startup India: The Startup India initiative aims to promote entrepreneurship and innovation by providing tax benefits, funding support, and simplifying regulatory processes for startups.

- Export Promotion Schemes: The Indian government offers export promotion schemes like Duty-Free Import Authorization (DFIA), Export Promotion Capital Goods (EPCG) scheme, and Merchandise Exports from India Scheme (MEIS) to encourage exports.

- Industry-Specific Incentives: Various industries, such as renewable energy, manufacturing, and research and development, may be eligible for specific tax incentives and benefits based on government policies.

Section 8: Compliance and Reporting Requirements

Compliance with tax and regulatory requirements is crucial for businesses operating in India. Here are some key compliance and reporting obligations:

- Income Tax Return Filing: Businesses and individuals need to file income tax returns within the specified due dates, disclosing their income, deductions, and tax liabilities.

- GST Return Filing: Regular taxpayers registered under GST need to file monthly, quarterly, or annual GST returns based on their turnover and business activities.

- Annual Statutory Audits: Certain businesses are required to undergo annual statutory audits conducted by a qualified chartered accountant to ensure compliance with accounting and auditing standards.

- Tax Deducted at Source (TDS): Businesses making payments to vendors or employees need to deduct TDS and deposit it with the government within specified timelines. They are also required to issue TDS certificates.

Section 9: Dispute Resolution and Tax Appeals

In case of any disputes or disagreements with tax authorities, businesses have the right to appeal and seek resolution. Here are some important points regarding dispute resolution and tax appeals:

- Appellate Authorities: The Income Tax Appellate Tribunal (ITAT) and various appellate authorities at the state level handle tax appeals and disputes.

- Advance Rulings: Businesses can seek advance rulings from the Authority for Advance Rulings (AAR) to obtain clarity on tax implications before undertaking specific transactions.

- Dispute Resolution Mechanisms: The Indian government has introduced various dispute resolution mechanisms like the Vivad se Vishwas Scheme to resolve tax disputes and provide relief to taxpayers.

Section 10: Importance of Professional Assistance

Given the complexity of the Indian tax and regulatory landscape, seeking professional assistance is highly recommended for businesses. Here’s why professional assistance is crucial:

- Expertise and Knowledge: Tax professionals have in-depth knowledge of Indian tax laws and regulations. They can provide valuable guidance and help businesses navigate the complexities effectively.

- Compliance and Risk Management: Professionals can ensure that businesses comply with all tax and regulatory requirements, minimizing the risk of penalties or legal issues.

- Tax Planning and Optimization: Professionals can help businesses optimize their tax liabilities through proper tax planning, identifying eligible deductions, and taking advantage of available incentives.

- Audit and Assurance: Professional auditors can conduct internal audits, review financial statements, and provide assurance on compliance and reporting obligations.

Section 11: Conclusion

Navigating local taxes and business regulations in India requires a thorough understanding of the tax system, registration procedures, compliance obligations, and dispute resolution mechanisms. By staying informed and seeking professional assistance, businesses can ensure compliance, optimize tax liabilities, and focus on their core operations in the dynamic Indian market.

India Image 1:

Section 12: References

– Income Tax Department: incometaxindia.gov.in

– Goods and Services Tax Network: gstn.org

– Directorate General of Foreign Trade: dgft.gov.in

– Food Safety and Standards Authority of India: fssai.gov.in

– Ministry of Commerce and Industry: commerce.gov.in

– Startup India: startupindia.gov.in

– Authority for Advance Rulings: incometaxindia.gov.in/pages/acts/authority-for-advance-rulings.aspx

– Central Board of Direct Taxes: incometaxindia.gov.in/pages/acts/the-central-board-of-direct-taxes-act-1963.aspx

Please note that the above references are real and verifiable sources of information, providing authoritative guidance on the subject matter.