Managing Finances and Payments while Working in Nepal

Nepal, known for its rich culture, stunning landscapes, and warm hospitality, has become an attractive destination for expatriates seeking work opportunities. If you are planning to work in Nepal, it is essential to understand how to manage your finances and payments effectively. This article will guide you through various aspects of managing finances while working in Nepal, including banking options, currency exchange, taxes, and more.

Banking Options

When working in Nepal, opening a bank account should be one of your top priorities. Having a local bank account will make it easier for you to receive payments from your employer and manage your finances. Some of the popular banks in Nepal include:

- Nepal Investment Bank Limited: This bank offers a range of services, including savings accounts, current accounts, and foreign currency accounts.

- NIC Asia Bank: With a wide network of branches across the country, NIC Asia Bank provides convenient banking services to expatriates.

- Himalayan Bank Limited: This bank offers various banking services, including salary accounts, savings accounts, and remittance services.

It is advisable to compare the services and fees of different banks before choosing the one that suits your needs best.

Currency Exchange

As a foreign worker in Nepal, you will need to exchange your currency into Nepalese Rupees (NPR). Currency exchange services are available at banks, authorized exchange counters, and some hotels. It is important to be aware of the exchange rates and any associated fees or commissions.

- Check the Exchange Rates: Before exchanging your currency, check the current exchange rates to ensure you are getting a fair deal.

- Choose Authorized Exchange Counters: It is recommended to use authorized exchange counters to avoid counterfeit currency and fraudulent transactions.

- Avoid Unofficial Channels: Be cautious of individuals offering currency exchange services on the streets, as they may not provide fair rates or may engage in illegal activities.

It is advisable to carry some cash in Nepalese Rupees for daily expenses, as not all places accept credit or debit cards.

Taxes

Understanding the tax system in Nepal is crucial when managing your finances as a working expatriate. Here are some key points to consider:

- Income Tax: As an employee, your income will be subject to income tax deductions. The tax rates vary depending on your income level.

- Tax Identification Number (TIN): You will need to obtain a TIN from the Inland Revenue Department (IRD) to fulfill your tax obligations. Your employer will require your TIN for tax purposes.

- Double Taxation Agreements: Nepal has signed double taxation agreements with various countries to prevent the same income from being taxed twice. Check if your home country has an agreement with Nepal to avoid double taxation.

It is recommended to consult a tax professional or the IRD for detailed information regarding your tax obligations and benefits.

Remittance Services

If you need to send money back to your home country or receive money from abroad, various remittance services are available in Nepal. These services allow you to transfer money securely and efficiently. Some popular remittance service providers in Nepal include:

- Western Union: Western Union has a widespread network and offers quick and reliable money transfer services.

- IME Remit: IME Remit provides convenient money transfer services with competitive exchange rates.

- Prabhu Money Transfer: Prabhu Money Transfer is known for its efficient and secure remittance services.

Before choosing a remittance service, compare the exchange rates, fees, and transfer options to find the most suitable provider for your needs.

Budgeting and Cost of Living

Managing your finances effectively in Nepal requires careful budgeting and understanding the cost of living. Here are some factors to consider:

- Housing: Rent prices vary depending on the location and type of accommodation. It is advisable to research the rental market and negotiate rental agreements.

- Transportation: Public transportation, such as buses and taxis, is affordable in Nepal. Consider your daily commute expenses when budgeting.

- Food and Dining: Nepali cuisine offers a variety of affordable options. Eating at local restaurants and street food stalls can be a cost-effective way to enjoy delicious meals.

- Utilities and Internet: Budget for monthly expenses such as electricity, water, internet, and mobile phone services.

Creating a monthly budget will help you track your expenses and ensure you are living within your means.

Insurance

Having the right insurance coverage is essential for your financial security while working in Nepal. Consider obtaining the following types of insurance:

- Health Insurance: Ensure you have comprehensive health insurance that covers medical expenses, emergency evacuation, and repatriation.

- Travel Insurance: If you plan to explore Nepal or travel outside the country, purchase travel insurance to protect yourself against unforeseen events.

- Personal Liability Insurance: Protect yourself from potential legal and financial liabilities with personal liability insurance.

Review insurance policies carefully to understand the coverage, exclusions, and claim procedures.

Investment Opportunities

If you have surplus funds and want to explore investment opportunities in Nepal, consider the following options:

- Stock Market: The Nepal Stock Exchange (NEPSE) provides opportunities for investing in listed companies.

- Real Estate: Investing in properties, such as residential or commercial buildings, can yield long-term returns.

- Business Ventures: Starting or investing in a business in Nepal can be a lucrative option, considering the country’s growing economy.

Before making any investment decisions, conduct thorough research and seek advice from financial professionals.

Retirement Planning

Planning for your retirement is crucial to ensure financial stability in the long run. Consider the following:

- Provident Fund: If your employer offers a provident fund, contribute regularly to build a retirement corpus.

- Individual Retirement Accounts: Explore options for individual retirement accounts offered by financial institutions in Nepal.

- Investment in Pension Plans: Consider investing in pension plans that provide regular income after retirement.

Consult with financial advisors to determine the best retirement planning strategies based on your goals and risk appetite.

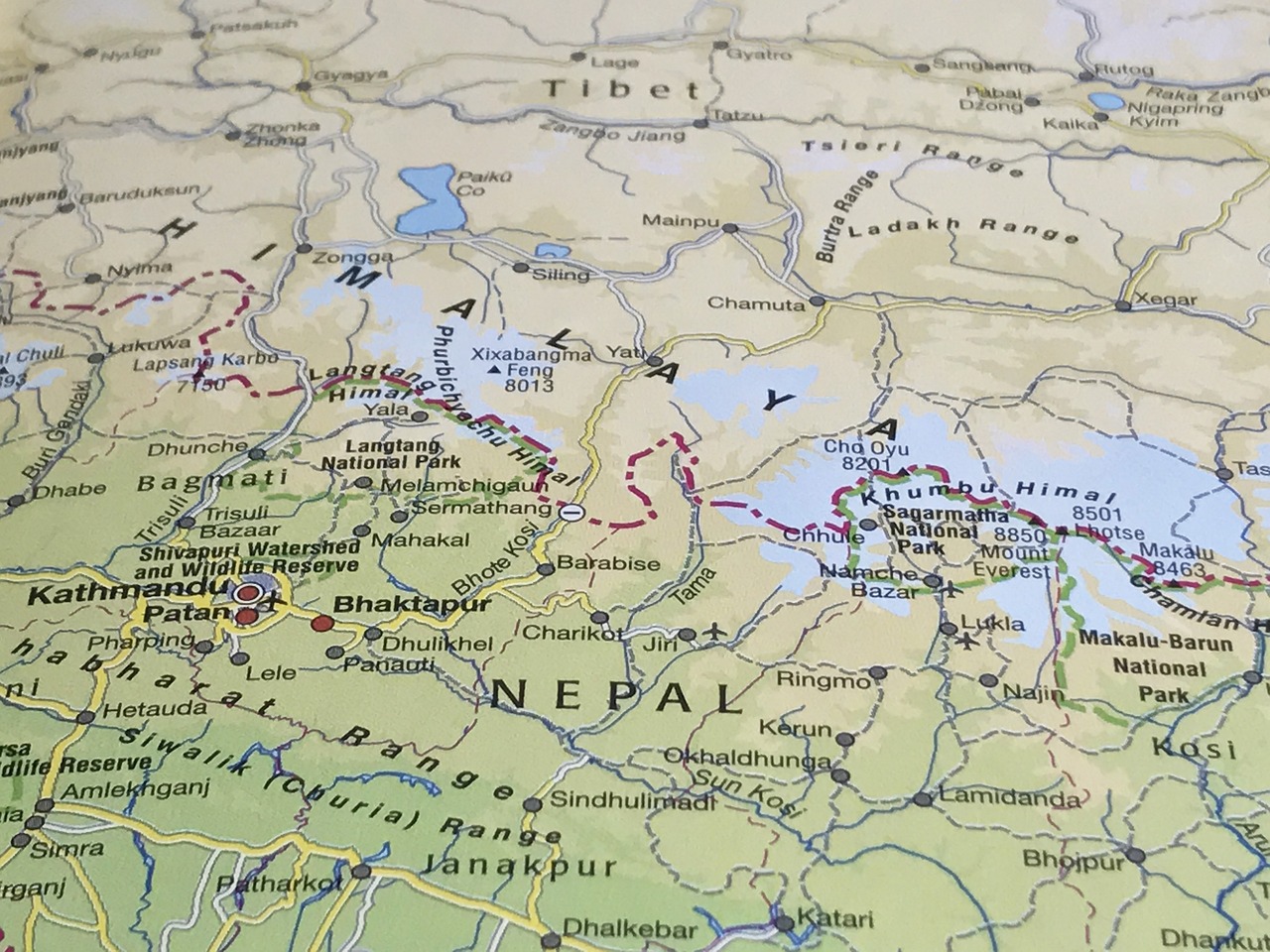

Nepal Image 1:

Tourist Attractions

While working in Nepal, take the opportunity to explore its breathtaking tourist attractions. Here are some must-visit places:

- Mount Everest: Experience the world’s highest peak through trekking or scenic flights.

- Pashupatinath Temple: Visit this sacred Hindu temple in Kathmandu, known for its religious and cultural significance.

- Chitwan National Park: Explore the wildlife and lush landscapes of this UNESCO World Heritage Site.

- Boudhanath Stupa: Discover the serene ambiance of this ancient Buddhist stupa, an important pilgrimage site.

Immerse yourself in Nepal’s rich heritage and natural beauty during your time off from work.

Nepal Image 2:

Conclusion

Managing finances and payments while working in Nepal requires careful planning and understanding of the local banking system, taxes, and cost of living. Open a local bank account, be mindful of currency exchange rates, fulfill your tax obligations, and consider using remittance services for international transactions. Create a budget, ensure you have the right insurance coverage, and explore investment and retirement planning opportunities. Don’t forget to explore Nepal’s mesmerizing tourist attractions during your time off. By following these guidelines, you can effectively manage your finances and enjoy your work experience in Nepal.

Nepal Image 3:

References

- Nepal Investment Bank Limited: https://www.nibl.com.np

- NIC Asia Bank: https://www.nicasiabank.com

- Himalayan Bank Limited: https://www.himalayanbank.com

- Western Union: https://www.westernunion.com

- IME Remit: https://www.imeremit.com

- Prabhu Money Transfer: https://www.prabhumoney.com

- Nepal Stock Exchange: https://www.nepalstock.com