Hungary Video

Navigating Local Taxes and Business Regulations in Hungary

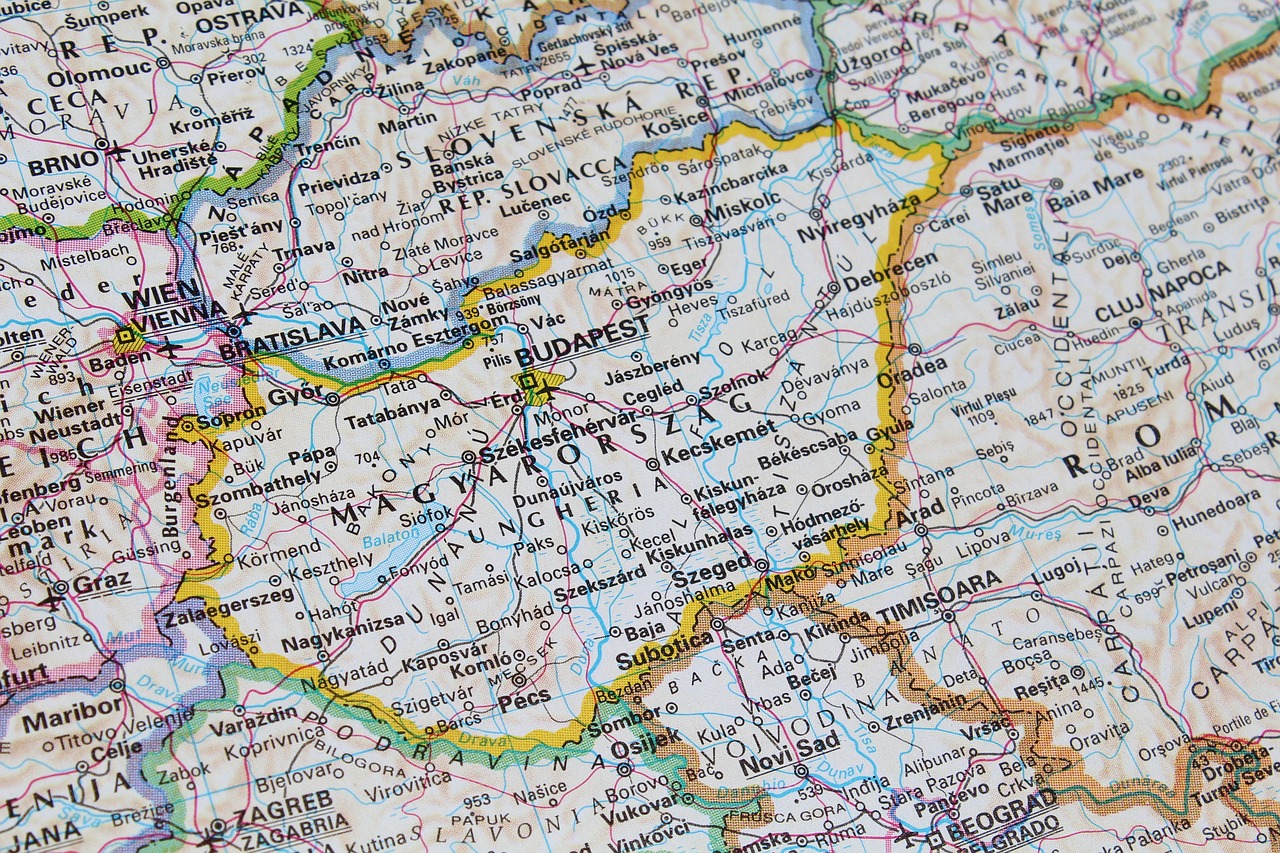

Hungary is a country located in Central Europe, known for its rich history, stunning architecture, and vibrant culture. If you are planning to start a business in Hungary or expand your existing business into the country, it is essential to understand the local taxes and business regulations that you will encounter. This article aims to provide you with a comprehensive guide to navigating local taxes and business regulations in Hungary.

Business Registration and Licensing

To establish a business presence in Hungary, you must go through the process of business registration and obtain the necessary licenses and permits. The Hungarian Trade Licensing Office (HTLO) is responsible for overseeing the registration of businesses and issuing licenses. Here are some key points to consider:

- Business Types: Hungary recognizes various business types, including sole proprietorships, partnerships, limited liability companies (LLCs), and joint-stock companies. Choose the most suitable legal structure for your business.

- Registration Process: The registration process involves submitting the necessary documents, such as the application form, articles of association, and proof of address. You may need to engage a lawyer or a licensed service provider to assist you.

- Licenses and Permits: Depending on the nature of your business, you may need specific licenses or permits. Examples include food handling permits, construction permits, and healthcare-related licenses. Consult with the HTLO or relevant authorities to determine the requirements.

Taxation in Hungary

Understanding the tax system in Hungary is crucial for businesses to comply with their obligations and effectively manage their finances. Here are the key taxes that businesses need to be aware of:

- Corporate Income Tax: The standard corporate income tax rate in Hungary is 9%. However, certain conditions and exemptions may apply. Consult with a tax advisor to understand the specific rules and regulations.

- Value Added Tax (VAT): Hungary applies a standard VAT rate of 27% on most goods and services. Reduced rates of 5% and 18% are applicable to specific categories. Businesses must register for VAT and comply with the reporting requirements.

- Personal Income Tax: Individuals are subject to progressive personal income tax rates ranging from 15% to 40%. The tax rates and thresholds are subject to annual changes, so it is essential to stay updated.

- Social Security Contributions: Employers and employees are required to contribute to social security funds. The rates vary depending on the income level and type of employment.

Employment Regulations

If you plan to hire employees in Hungary, it is crucial to understand the local employment regulations. Here are some key points to consider:

- Employment Contracts: Employment contracts must be in writing and include essential terms and conditions, such as working hours, wages, and duration of employment. Special provisions apply to fixed-term contracts and part-time work.

- Minimum Wage: Hungary has a statutory minimum wage, which is revised annually. It is essential to comply with the minimum wage requirements and any subsequent changes.

- Working Hours: The standard working week in Hungary is 40 hours. Overtime work is subject to additional compensation or time-off in lieu.

- Employee Benefits: Hungarian labor law grants employees various benefits, including paid leave, sick leave, maternity/paternity leave, and public holidays. Familiarize yourself with the specific entitlements.

Intellectual Property Rights

Protecting your intellectual property (IP) is crucial for businesses operating in Hungary. The Hungarian Intellectual Property Office (HIPO) is responsible for the registration and protection of IP rights. Consider the following:

- Trademarks: Registering a trademark with the HIPO provides exclusive rights to use and protect your brand identity in Hungary. Conduct a thorough search to ensure your trademark is unique and not infringing on existing rights.

- Patents: Patents protect inventions and technical solutions. The HIPO grants patent rights to inventors, providing them with exclusive rights to exploit their inventions in Hungary.

- Copyright: Copyright protection covers literary, artistic, and scientific works. Original creations, such as books, music, and software, are automatically protected by copyright laws.

Environmental Regulations

Businesses operating in Hungary must comply with environmental regulations to minimize their impact on the environment. Here are some key considerations:

- Environmental Permits: Certain activities, such as waste management or industrial production, may require environmental permits. Consult with the Hungarian Environmental Authority for specific requirements.

- Waste Management: Businesses must adhere to waste management regulations, including proper disposal and recycling practices. Familiarize yourself with the waste classification and disposal procedures.

- Energy Efficiency: Hungary promotes energy-efficient practices. Consider implementing energy-saving measures and exploring available incentives to reduce energy consumption.

Consumer Protection

Hungary has consumer protection laws in place to safeguard the rights and interests of consumers. Businesses must comply with these regulations. Consider the following:

- Product Safety: Ensure that your products meet safety standards and carry appropriate labeling and instructions. Non-compliance can lead to fines and legal consequences.

- Advertising and Marketing: Advertisements must be truthful, not misleading, and comply with specific regulations. Avoid unfair commercial practices and deceptive advertising.

- Consumer Contracts: Consumer contracts must be fair and transparent. Avoid unfair terms and conditions that may disadvantage consumers.

Local Business Support

Hungary offers various resources and support for businesses. Take advantage of these opportunities to facilitate your operations and growth. Consider the following:

- Investment Incentives: Hungary provides investment incentives, such as tax breaks, grants, and subsidies, to attract foreign investment. Explore the available incentives for your industry.

- Business Networks: Join local business associations and networks to connect with other entrepreneurs and gain valuable insights into the Hungarian market.

- Government Support: The Hungarian government offers support programs and initiatives to assist businesses. Stay updated on relevant policies and funding opportunities.

Hungary Image 1:

Conclusion

Navigating local taxes and business regulations in Hungary is essential for the success of your business venture in the country. By understanding the registration process, taxation requirements, employment regulations, intellectual property rights, environmental regulations, consumer protection laws, and available business support, you can ensure compliance and make informed decisions. Seek professional advice and stay updated with the latest regulations to navigate the Hungarian business landscape effectively.

Hungary Image 2:

References

- Hungarian Trade Licensing Office: ht.gov.hu

- Hungarian Intellectual Property Office: sztnh.gov.hu

- Hungarian Environmental Authority: kvvm.hu

Hungary Image 3: